Bitcoin's Resilient Stance: A Bullish Grounding Amidst 3-Week $38K Consolidation

Over the last three weeks, there has been a noticeable shift in the dynamics of Bitcoin's price behavior, indicating a burgeoning bullish sentiment, as emphasized by an observer in the market. Despite Bitcoin's recent consolidation below the $38,000 threshold, there exists a positive undertone characterized by minor price declines, hinting at the possibility of an upward trajectory.

Since November 9, Bitcoin's upward price momentum has faced resistance in the vicinity of the $38,000 level. However, experts advise against interpreting this as the conclusion of the ascending trend. A meticulous analysis of the price movements during this consolidation phase reveals a distinct pattern. Although gains have been confined around the $38,000 mark, subsequent pullbacks have been shallow and brief. This pattern indicates a sustained inclination to "buy the dip," leading to the recognition of an ascending triangle formation on the price chart.

The ascending triangle, a technical pattern delineated by market technician Charles D. Kirkpatrick II and analyst Julie R. Dahlquist, often culminates in a bullish breakout, extending the preceding uptrend. According to their book, "Technical Analysis: The Complete Resource for Financial Market Technicians 3rd Edition," upward breakouts manifest around 77% of the time. The potential breakout could transpire at approximately 61% of the distance or time from the base to the cradle. Nevertheless, the authors caution against false breakouts, where prices momentarily breach resistance only to swiftly retract, trapping buyers on the wrong side of the market.

Alex Kuptsikevich, a senior market analyst at FxPro, observes Bitcoin's movement within an ascending channel, reaching the upper resistance of $37.8K. Despite efforts to stimulate the price amid an escalating sell-off, the shallower pullbacks over the past three weeks indicate a growing bullish sentiment. Kuptsikevich speculates that a potential breakout from the ascending triangle could propel Bitcoin beyond $40,000.

Decoding Market Trends: Unveiling the Ascending Triangle Pattern through Horizontal Resistance and Upward-Sloping Support. Source:TradingView

Decoding Market Trends: Unveiling the Ascending Triangle Pattern through Horizontal Resistance and Upward-Sloping Support. Source:TradingView

Markus Thielen, the head of research and strategy at Matrixport, echoes this sentiment, proposing that a breakout might set Bitcoin's sights on $45,000. Data from Skew, an anonymous market analyst, discloses the unwinding of short perpetual futures positions on Bybit and renewed interest in bullish positions on Binance. The unwinding of short positions, typically anticipating a price drop, often exerts upward pressure on prices, suggesting that the persistent resistance near $38,000 might face a challenge soon.

$BTC Binance & Bybit Open Interest / Delta

— Skew Δ (@52kskew) November 24, 2023

Large long opening on binance futures here & large short puked on bybit perps

Perp CVD & Delta

Perp driven price action here clearly from OI & change in perp delta

~ driven by big long opening & short puking in the same timeframe pic.twitter.com/CHs8LGwKjj

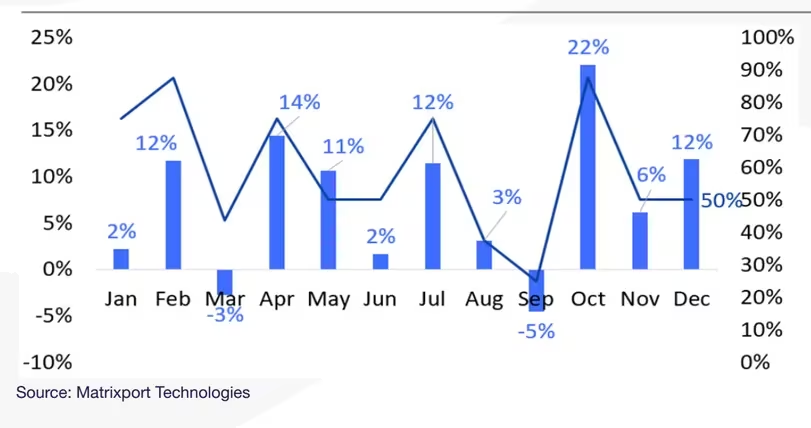

Adding credence to the optimistic outlook is the seasonal trend. Historical data tracked by Matrixport indicates that, on average, Bitcoin has gained 12% in December over the past eight years. Markus Thielen suggests that, based solely on seasonal patterns, Bitcoin could potentially reach $42,000.

Cryptocurrency on the Rise: Matrixport's Insightful Analysis on Seasonal Momentum

Cryptocurrency on the Rise: Matrixport's Insightful Analysis on Seasonal Momentum

In conclusion, prevailing market indicators and technical patterns strongly suggest the potential for a bullish breakout for Bitcoin. The formation of the ascending triangle and the shallower pullbacks indicate that the cryptocurrency is accumulating momentum for the forthcoming upward movement. Coupled with the seasonal trend, these factors contribute to a positive projection for Bitcoin's price in the weeks ahead.

Read More: BlurToken Rally: Bullish Surge Amidst Binance Buzz

Trending

Press Releases

Deep Dives