Bitcoin's Enigmatic Trajectory: From Momentum to Resilience

The surging and bullish momentum that once catapulted Bitcoin (BTC) tickers to $26,001, achieving an impressive year-to-date gain of 57.8%, has gradually evaporated over the course of this week. In the span of the last 7 days, Bitcoin's value has descended by a significant 9.1%. Currently, the Bitcoin price languishes beneath the critical threshold of the 20-week exponential moving average, nestled at $27,750. The reclamation of this pivotal level is essential for any hope of rekindling even a modicum of bullish fervor.

Astute analysts are drawing intriguing parallels between the current contraction of the BTC market and the reminiscent pre-bull market phase spanning from 2015 to 2017. A deeper dive into the underlying dynamics is necessary to unravel the complex tapestry of factors shaping the present Bitcoin price landscape.

Bitcoin's daily price chart against the US Dollar (BTC/USD), data sourced from TradingView.

Bitcoin's daily price chart against the US Dollar (BTC/USD), data sourced from TradingView.

Perplexing Standstill in Bitcoin Investor Sentiment:

The dawn of 2023 bore witness to an intriguing phenomenon – a persistent dominance of short positions within the futures market, culminating in a recurring spectacle of liquidations. The plot thickened on August 17, as a seismic shock reverberated across the market with the sudden liquidation of long positions, amounting to an eye-watering sum exceeding $213.5 million. This pronounced event etched its name in history as the most substantial single-day Bitcoin long liquidation since the infamous Terra Luna collapse back in May 2022.

Bitcoin futures experiencing liquidation of long positions, data derived from Glassnode.

Bitcoin futures experiencing liquidation of long positions, data derived from Glassnode.

This cascade of liquidations, bereft of the much-needed counterbalance of buying pressure derived from trading volume, unleashed a deleterious ripple effect on the Bitcoin price trajectory. A somber note reverberates through the realm of Bitcoin trading volumes, reaching nadirs not witnessed since the early months of 2021. To add an extra layer of intrigue, the BTC Ordinals volume has nosedived, plummeting by a staggering 98%.

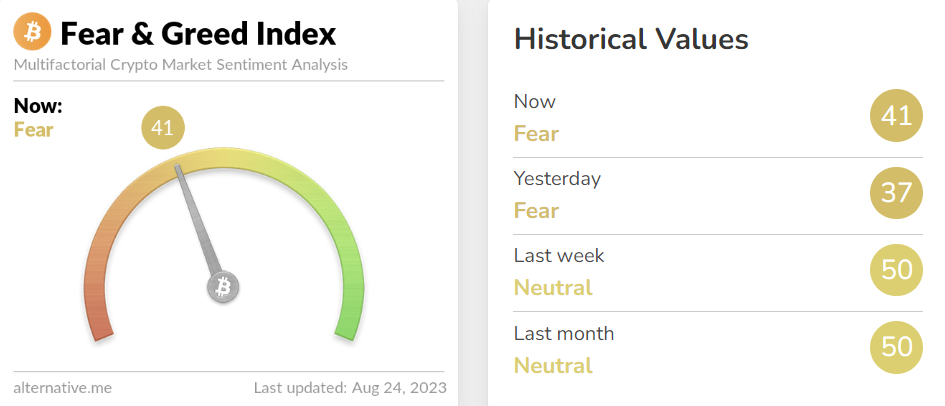

This enigmatic absence of consistent trading volumes has birthed a remarkable narrative – the Fear and Greed Index, a compass into investor sentiment, has descended into a mystifying downtrend over the past 30 days.

Index gauging Fear & Greed sentiment. Data source: Alternative.me.

Index gauging Fear & Greed sentiment. Data source: Alternative.me.

Intrigue and uncertainty abound within the crypto arena. Notably, the prevailing climate of uncertainty has yet to significantly sway the long-term perspective of institutional investors. Their stance remains remarkably steadfast, even in the face of a prickly U.S. regulatory landscape. These titans of finance are unflinchingly advocating for the integration of Bitcoin-based financial instruments, poised to unleash a torrent of bullish sentiment. Notably, Grayscale stands at the forefront, brandishing its direct petition to the SEC for the green light on all Bitcoin ETFs.

However, the regulatory juggernaut that is the SEC appears resolute in its mission to extend the gestation period for Bitcoin ETF approvals, a waiting game projected to persist until the year 2024. This protracted delay looms as a specter, potentially exerting a dampening effect on investor sentiment and playing a pivotal role in the broader tango of price movements across the cryptosphere.

The Ongoing Odyssey of Bitcoin's Options:

A dramatic tale unfolds within the intricate web of Bitcoin's market structure. The structural revival that characterized the inception of 2023 has undergone a metamorphosis, as recent price dynamics have propelled this structure into a decidedly bearish trajectory. Intriguingly, despite the conspicuous surge in Bitcoin's open interest, an eerie absence of consolidation above the $30,000 echelon has been the prevailing theme.

Conjecture is rife among analysts, positing the likelihood of a dramatic correction, hurtling prices back to the $29,000 threshold. Amidst these musings, whispers of a clandestine orchestration by BlackRock to suppress Bitcoin prices ahead of their much-anticipated ETF launch have woven a tantalizing subplot. Yet, the practical implications of such a maneuver are awash with complexity, dampening the resonance of this conspiracy.

In the Shadows of Downturn, a Ray of Hope Persists:

Even amidst the murky terrain of Bitcoin's present price trajectory, the eminent Pantera Capital champions an unwavering optimism, projecting the tantalizing possibility of a meteoric ascent to $148,000 by the time July 2025 unfurls its banners.

The Symbiotic Dance of Short-Term Struggles and Long-Term Triumphs:

Bitcoin's undulating journey remains inextricably intertwined with the grand tapestry of macroeconomic events. The ebb and flow of regulatory undertakings and interest rate volleys continue to cast their shadows on the enigmatic dance of BTC's valuation. These macroscopic reverberations have engendered a notable contraction in crypto venture capital inflows, as diligently cataloged by Cointelegraph's research efforts.

All eyes now turn to the eminent Federal Reserve Chairman Jerome Powell, poised to deliver a pivotal address on August 25th in Jackson Hole. Anticipation brews as market spectators await insights into the future trajectory of the Fed's unwavering commitment to its resolute interest rate policies.

Brian D. Evans, the helmsman of BDE Ventures, provides a profound commentary on the symphony of macroeconomic events and their tangible impacts on Bitcoin's present price action:

"While the edifice of economic growth still stands on relatively steady ground, faint whispers of vulnerability emerge. The ebbs of inflation have grown perceptible, as central banks marshal their resources, poised to unleash torrents of liquidity, bolstering tottering banking systems and rekindling the embers of ailing economies. In this chiaroscuro of circumstances, a prolonged dalliance with sideways movements seems inevitable. As the market eventually orchestrates its next celestial rise, the perennial skeptics may once again find themselves on the periphery, mere spectators to the grand unfolding."

In the chronicles of the distant future, steadfast participants of the market harbor a sanguine belief in the resurrection of Bitcoin's price fortunes. This conviction gains even more traction, as an ever-expanding brigade of financial institutions opens its doors to embrace the burgeoning potential of BTC.

Trending

Press Releases

Deep Dives