Bitcoin's Bullish Signals

Bitcoin's recent price performance has been a topic of intense scrutiny, as BTC's tickers have dipped to the level of $26,050. This has raised concerns among many analysts who are speculating about the potential for bearish momentum in the weeks to come. However, not too long ago, a wave of optimism swept through the investor and crypto pundit communities, driven by some significant fundamental indicators that continue to signal a bullish sentiment. Let's take a closer look at three key Bitcoin metrics that have garnered attention and should be on the radar of bullish enthusiasts.

The Bitcoin network's hash rate remains close to an all-time high

To begin with, Bitcoin's hash rate is currently hovering near an all-time high, signifying the substantial computational power dedicated to mining BTC. This metric underscores the robustness of the network and the sustained interest from miners. It serves as a clear indication that miners maintain a high degree of confidence in the future of the Bitcoin network.

There has been an ongoing debate about whether a high hash rate serves as a reliable bullish signal. Some investors interpret the increase in hashing power as a precursor to impending price surges, while others hold contrasting views or even argue that there is no direct correlation.

Upon examining data from the past year, a discernible relationship between hash rate and price trends emerges.

Comparison of Bitcoin's overall hash rate and its market price in USD over a one-year period, sourced from Blockchain.com

Comparison of Bitcoin's overall hash rate and its market price in USD over a one-year period, sourced from Blockchain.com

This connection is logical since miners tend to ramp up their mining activities in response to rising prices. Moreover, the hash rate is influenced by the regular Bitcoin difficulty adjustment, occurring approximately every two weeks. As the hash rate climbs, so does the difficulty, making it more energy-intensive to mine a single BTC. A sustained high hash rate can only support lower prices for a limited period because the cost of production for miners escalates with increasing difficulty, while their profits dwindle. Consequently, either prices must experience an uptick, or the hash rate will inevitably decline.

At present, there exists a noticeable disparity between the price and hash rate, reminiscent of a similar scenario observed in June, which was subsequently followed by a rally. Additionally, there appears to be renewed interest in Bitcoin mining from nation-states, with Oman making headlines by announcing plans to account for 7% of the Bitcoin hash rate within the next two years.

The number of Bitcoin wallets with holdings of 0.1 BTC or more has reached its highest point ever

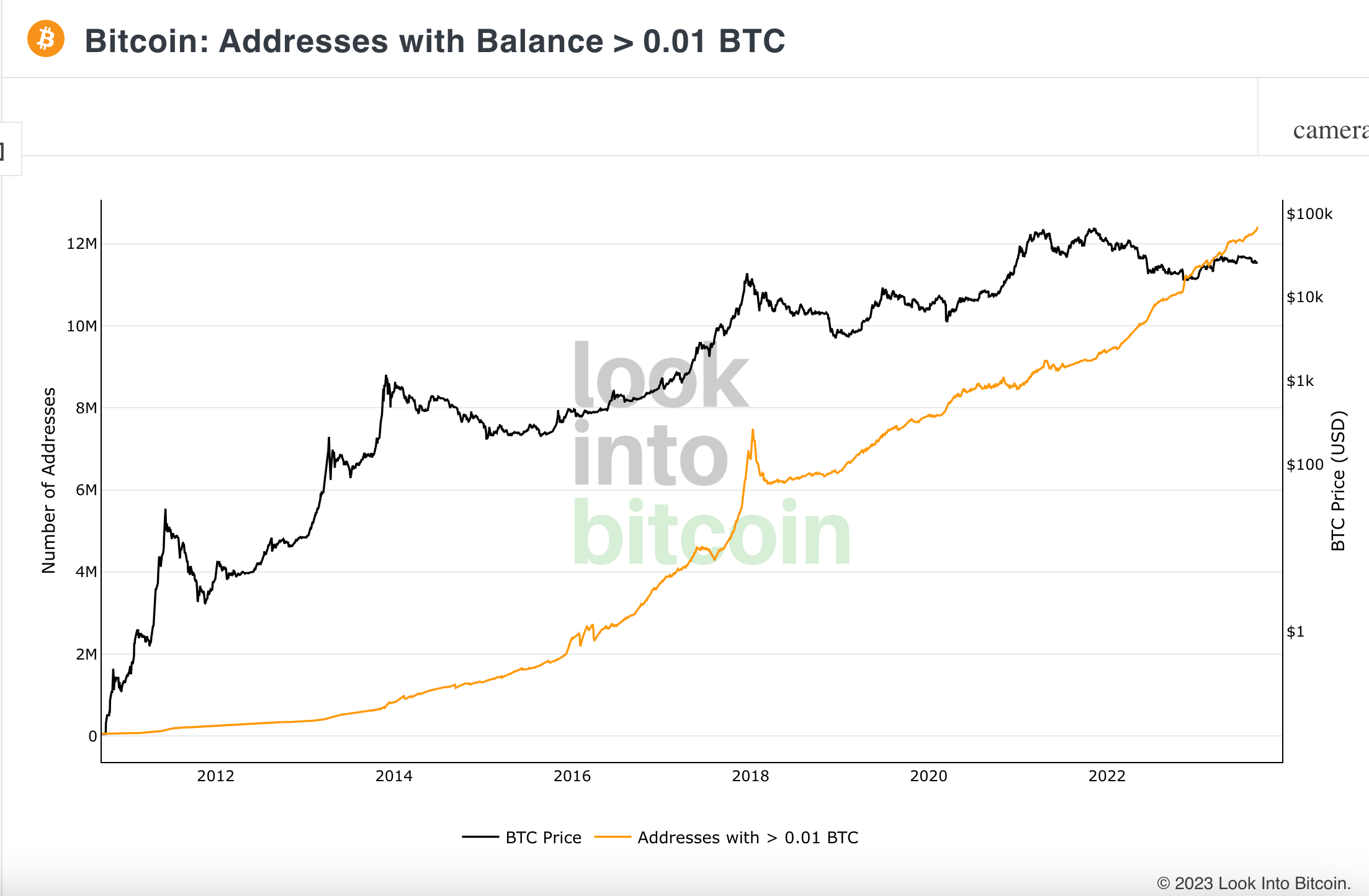

Moving on to our second point of analysis, the number of Bitcoin addresses holding 0.1 BTC or more has recently reached an all-time high, surpassing the milestone of 12 million addresses. This phenomenon underscores the resilience of Bitcoin hodlers who have demonstrated remarkable commitment during the bear market, regardless of price fluctuations and occasional corrections.

Bitcoin wallet addresses containing a balance exceeding 0.01 BTC compared with its price, sourced from Look Into Bitcoin

Bitcoin wallet addresses containing a balance exceeding 0.01 BTC compared with its price, sourced from Look Into Bitcoin

It serves as a compelling testament to the unwavering trust placed in the asset class, even in the face of prevailing market uncertainties. While 0.1 BTC may have previously seemed inconsequential, it now represents approximately $2,500 at current price levels, and its fiat value can be significantly higher when denominated in other currencies. The fact that 12 million entities have accumulated this quantity of Bitcoin underscores the increasing global seriousness and recognition of such investments.

There is a declining trend in the quantity of Bitcoin stored on cryptocurrency exchanges

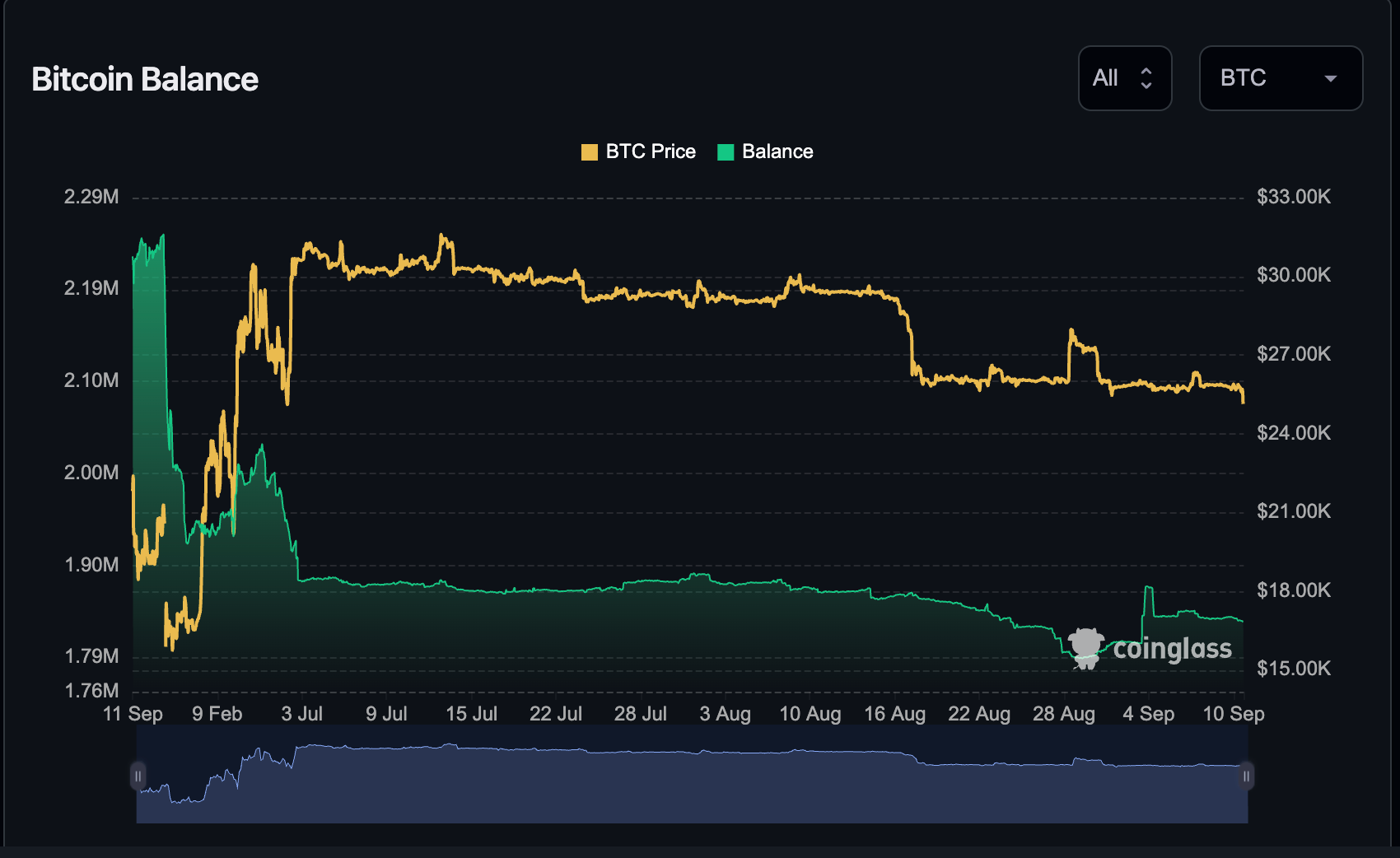

Finally, let's turn our attention to the third metric, where the number of wallets holding substantial Bitcoin balances has shown a consistent upward trend. Simultaneously, the amount of Bitcoin held on cryptocurrency exchanges has been steadily decreasing since the collapse of FTX in November 2022, with this trend accelerating since April 2023. This pattern suggests that individuals are increasingly opting for self-custody of their coins, potentially signaling their reluctance to sell in the near future.

One-year chart depicting the correlation between BTC price and the amount of Bitcoin held on exchanges, with data sourced from Coinglass

One-year chart depicting the correlation between BTC price and the amount of Bitcoin held on exchanges, with data sourced from Coinglass

In the past week alone, the BTC balance held on exchanges has declined from 1.88 million to 1.84 million. Historically, an influx of coins onto exchanges has often foreshadowed selling pressure, while outflows from exchanges have provided crucial support to the Bitcoin price.

In summary, when these three metrics are considered collectively, a compelling narrative emerges: the rationale for investing in Bitcoin has never been stronger. Miners continue their dedicated efforts, hodlers remain steadfast, and individuals are increasingly taking control of their coin custody. These factors, combined with the evolving dynamics of the cryptocurrency market, paint a picture of optimism amidst the complex landscape of digital assets.

Trending

Press Releases

Deep Dives