Bitcoin's Battleground: Volatility and Resilience

Bitcoin's Symbol: BTC Ticker Dips: $25,940.Emerging into a fresh week, traders are tending to their wounds following a sharp 10% crash that left the market in a state of unease.

BTC's price movement is grappling to rebound from a turbulent end to the prior week, and apprehension hangs in the air as the next few days are anticipated to hold similar volatility.

With the spotlight on the $26,000 mark for now, speculation is rife about Bitcoin's next direction.

A convergence of various factors is on the horizon to exert influence: The United States' macroeconomic data releases are regaining momentum, and the Federal Reserve is gearing up to deliver crucial insights on the economy at the annual Jackson Hole Economic Symposium.

Within the realm of Bitcoin, short-term holders now find themselves grappling with mounting unrealized losses, while on-chain transactions reflecting losses are reaching multiyear highs.

Sentiment has taken a hit, but does the prevailing fear hold merit?

BTC Order Book: A Deserted Landscape Following OI Wipeout

Amid expectations that volatility would surge around the weekly close on August 20th, Bitcoin surprised many, exhibiting a nonchalant performance, as data from Cointelegraph Markets Pro and TradingView illustrates. Its uptrend was capped at $26,300.

A subsequent downturn brought the market back to the $26,000 level, where it remains at the time of writing.

1-hour chart of BTC/USD sourced from TradingView.

1-hour chart of BTC/USD sourced from TradingView.

Post a tumultuous week, both traders and analysts remain cautiously optimistic, with various triggers for further downward movement being discussed.

"Traders remain wary, projecting further declines," noted trading suite DecenTrader in an update on August 21st.

Decentrader highlighted that traders across exchanges had positioned themselves for declines after a substantial open interest wipeout during the preceding week's plunge.

"Negative funding rates persist," the suite added.

Maartunn, a contributor to the on-chain analytics platform CryptoQuant, likened Binance's order book liquidity to a "ghost town."

"This may pave the way for volatility, in case you haven't noticed," he suggested alongside a chart displaying liquidity and whale order volumes from monitoring resource Material Indicators.

BTC/USD order book information and significant trading volumes from large players on Binance, as reported by Maartunn on the X platform.

BTC/USD order book information and significant trading volumes from large players on Binance, as reported by Maartunn on the X platform.

Nevertheless, Maartunn rationalized that historical precedent could pave the way for upside.

"Throughout Bitcoin's entire history, there have been 11 instances where Open Interest saw a comparable decline as observed three days ago. Out of these eleven, eight resulted in price hikes, while three did not," stated a segment of a separate analysis.

Bitcoin Traders Contemplate a "Consolidation Scenario"

A calm weekend prompted some traders to consider new possibilities. It is argued that Bitcoin might now be transitioning into a phase of rangebound trading.

"Bitcoin has reverted back to the previous range. The most likely scenario for the coming week is to continue trading within the range, in my opinion," suggested prominent trader CrypNuevo to subscribers.

"I anticipate a false downward movement to $25,700-$25,800 on Monday, followed by a relief rebound throughout the week, aiming for the mid-range at $27,000."

Annotated chart depicting BTC/USD movements, sourced from CrypNuevo on the X platform.

Annotated chart depicting BTC/USD movements, sourced from CrypNuevo on the X platform.

Another trader, Crypto Tony, identified a reclaim of the local peak at $26,300 over the weekend as a trigger for action.

"Until then, I'm patiently awaiting Bitcoin's next move," he concluded.

Maartunn similarly acknowledged the possibility of a consolidation period for BTC/USD.

Another possible scenario for #Bitcoin is a period of consolidation.

— Maartunn (@JA_Maartun) August 20, 2023

This is not unlikely, as we have witnessed such consolidation multiple times in the past following significant market movements.https://t.co/pfl62msjJm pic.twitter.com/1jeRb6eJfL

On the weekly timeframe, trader Skew outlined multiple scenarios: uptrend, downtrend, and consolidation, all within the realm of possibility.

"A consolidation scenario would involve fluctuations between $25,000 and $30,000, forming a long-term range," he affirmed alongside an illustrative chart.

Annotated chart illustrating BTC/USD trends, sourced from Skew on the X platform.

Annotated chart illustrating BTC/USD trends, sourced from Skew on the X platform.

Critical Timing for Powell's Jackson Hole Address

While the previous week saw minimal U.S. macroeconomic data releases, the upcoming five days are poised to bring a change in tempo.

U.S. jobless claims are slated for August 24th, with housing sales and other data preceding them.

"Volatility has made a triumphant return," summarized financial commentary source The Kobeissi Letter for subscribers.

Key Events This Week:

— The Kobeissi Letter (@KobeissiLetter) August 20, 2023

1. Existing Home Sales data - Tuesday

2. US Services PMI data - Wednesday

3. New Home Sales data - Wednesday

4. Core Durable Goods data - Thursday

5. Initial Jobless Claims - Thursday

6. Fed Chair Powell Speaks - Friday

Volatility is officially back.

However, traders and analysts are primarily focused on Jerome Powell, chair of the Federal Reserve, who will deliver a keynote address at the annual Jackson Hole Economic Symposium on August 25th.

Jackson Hole has historically been a breeding ground for market volatility, and given the present climate, this year's event is expected to be no exception.

"The Federal Reserve's annual Jackson Hole meeting carries unprecedented significance this week," added Kobeissi.

Powell will share the stage with speakers like Christine Lagarde, the president of the European Central Bank.

With both the Nasdaq and S&P 500 joining the cryptocurrency market in a week of losses, historical trends might still reverse the tables, as Jackson Hole traditionally serves as a source of risk-on relief.

More often than not, stocks rise the week after Jackson Hole

— Markets & Mayhem (@Mayhem4Markets) August 20, 2023

Will this year follow the pattern, or will it be one of the outlier years with a sell-off? ???? pic.twitter.com/QPST4p9HUs

Popular trader and analyst Miles Johal expressed optimism, noting that, unlike stocks and Bitcoin, the U.S. dollar's strength is encountering resistance.

"SPX - In an uptrend, currently at a support level and oversold. BTC - Uptrend, finding support and oversold. DXY - In a downtrend, facing resistance and overbought. US10Y - Exhibiting a double top pattern, at resistance and overbought," he elaborated to X subscribers.

"The alignment is quite clear. Following the correction, both $BTC and equities are biased towards a vertical uptrend."

Annotated chart comparing macro assets, attributed to Miles Johal on the X platform.

Annotated chart comparing macro assets, attributed to Miles Johal on the X platform.

Kobeissi added that the equity put/call ratio reached its highest point since the beginning of 2023, hinting at an impending surge in volatility.

"Are the markets bracing for a substantial setback, or is another short squeeze on the horizon?" the question was posed.

On-Chain Losses Pile Up as Speculators Feel the Strain

Unsurprisingly, Bitcoin's 11% drop prompted significant shifts in on-chain profitability metrics.

Among these metrics is the adjusted spent output profit ratio (aSOPR), which gauges the collective profitability of all transactions, excluding those under an hour old.

This ratio, which compares the price sold to the price paid, has now dipped below 1, marking the boundary between profit and loss. This figure is at its lowest in five months, as per data from on-chain analytics firm Glassnode.

Chart depicting Bitcoin's aSOPR (adjusted spent output profit ratio), sourced from Glassnode on the X platform.

Chart depicting Bitcoin's aSOPR (adjusted spent output profit ratio), sourced from Glassnode on the X platform.

Glassnode also disclosed that the seven-day average number of unspent transaction outputs (UXTOs) in loss has hit a three-year peak.

Chart illustrating Bitcoin's unspent transaction outputs (UTXOs) in a state of loss, as sourced from Glassnode on the X platform.

Chart illustrating Bitcoin's unspent transaction outputs (UTXOs) in a state of loss, as sourced from Glassnode on the X platform.

During a similar retracement in August, BTC/USD witnessed in 2020, Bitcoin plunged before rapidly recovering, culminating in a surge to new all-time highs later that year.

This time, speculators bore the brunt of the impact, as Bitcoin's current trading price falls beneath the cost basis, or realized price, of short-term holders (STHs), entities holding BTC for less than 155 days.

Chart displaying the realized price of Bitcoin's hodler cohort, sourced from Glassnode.

Chart displaying the realized price of Bitcoin's hodler cohort, sourced from Glassnode.

Familiar Fear

Could the resilience of Bitcoin outweigh the market's negative sentiment?

Sentiment data suggests that a knee-jerk response characterized recent BTC price movements, and the dust may yet settle.

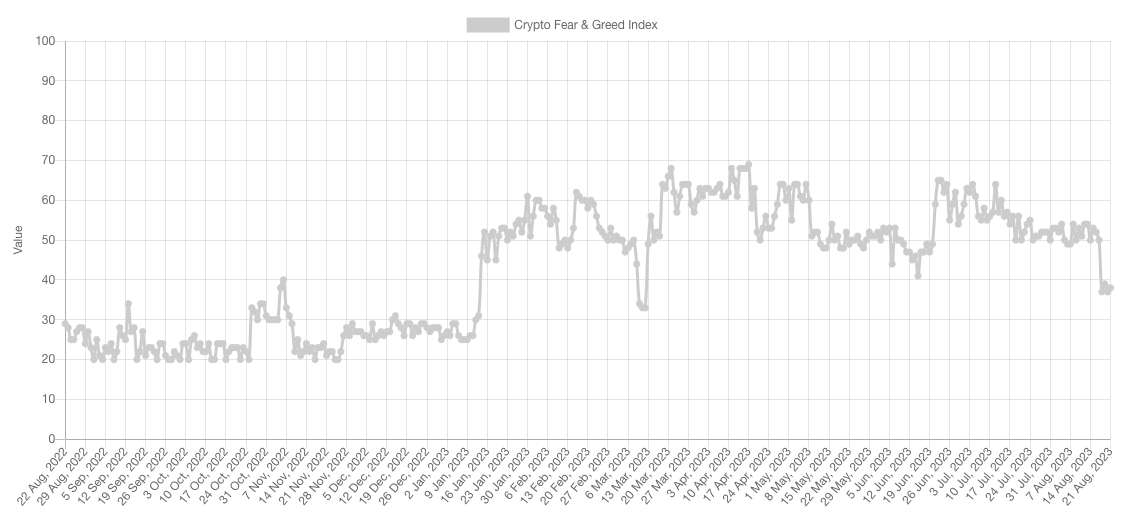

According to the Crypto Fear & Greed Index, the average crypto investor is currently more anxious than they have been since the Silicon Valley Bank (SVB) collapse in March.

With a score of just 38/100, "fear" has firmly taken the reins as the new week begins, witnessing a 16-point drop over the past seven days.

Screenshot of the Crypto Fear & Greed Index, obtained from Alternative.me.

Screenshot of the Crypto Fear & Greed Index, obtained from Alternative.me.

In the midst of calls for a more balanced assessment of the status quo is the trading team at Stockmoney Lizards. They argue that BTC's price performance regularly encounters the sort of setback witnessed last week, making this month's developments nothing unprecedented.

"In the wake of the Bitcoin sell-off, the cry for a $10K price is echoing," they summarized over the weekend, reflecting on a comparative chart displaying price action in the current halving cycle in contrast to the previous one.

"The annals of BTC are replete with such sell-offs, and the market will rebound from it, just as it has in the past."

Comparative chart depicting BTC/USD trends, credited to Stockmoney Lizards on the X platform.

Comparative chart depicting BTC/USD trends, credited to Stockmoney Lizards on the X platform.

Prominent trader and analyst Rekt Capital provided more detail, pointing out numerous 20%+ drawdowns in 2023 alone on BTC/USD.

All #BTC pullbacks in 2023:

— Rekt Capital (@rektcapital) August 17, 2023

• Early February -12%

• Late February -22%

• March -9%

• April to June -20%

• July to August -12%$BTC #Crypto #Bitcoin pic.twitter.com/4pmBXPY0fp

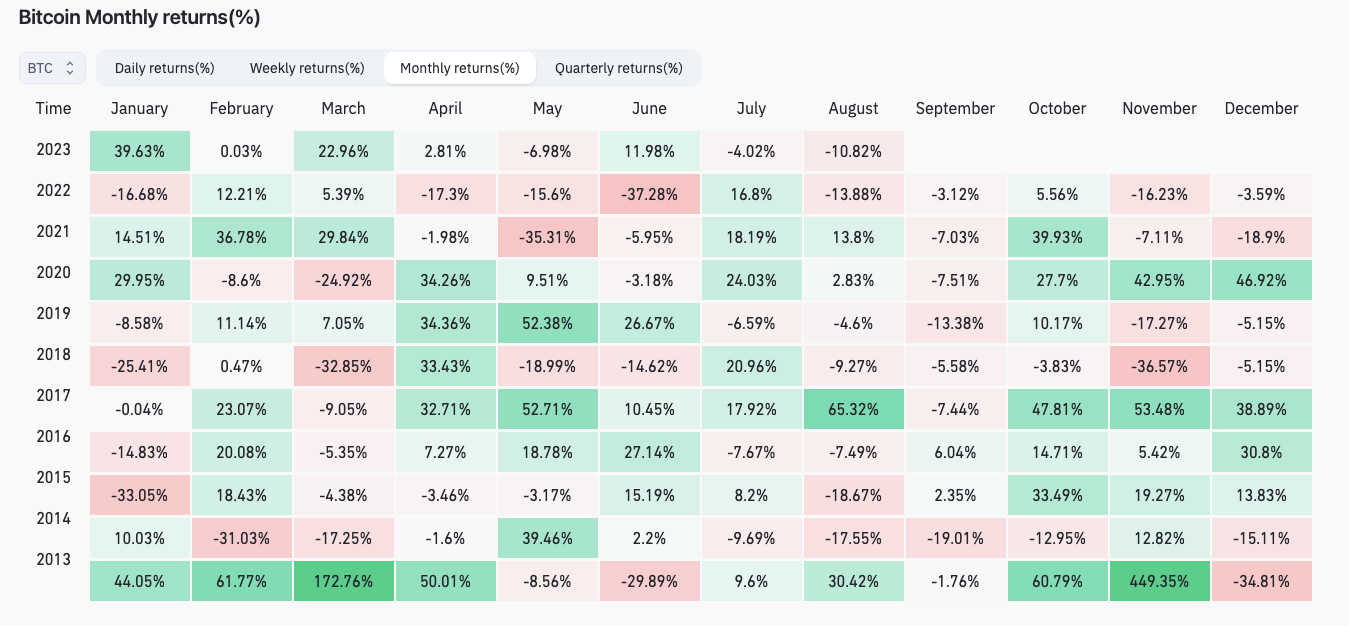

Data from monitoring resource CoinGlass reflects August 2023 losses at -10.8% as of August 21st.

Screenshot of the table showing monthly returns for BTC/USD, sourced from CoinGlass.

Screenshot of the table showing monthly returns for BTC/USD, sourced from CoinGlass.

Trending

Press Releases

Deep Dives