Bitcoin Volume Decline Amid Economic Uncertainty

The trajectory of Bitcoin, represented by its ticker BTC, is currently undergoing a downward slide, with its price residing at $26,216. The exchanges are grappling with a noticeable slump in trading volume, which can be attributed to the persistent macroeconomic uncertainties that traders are contending with.

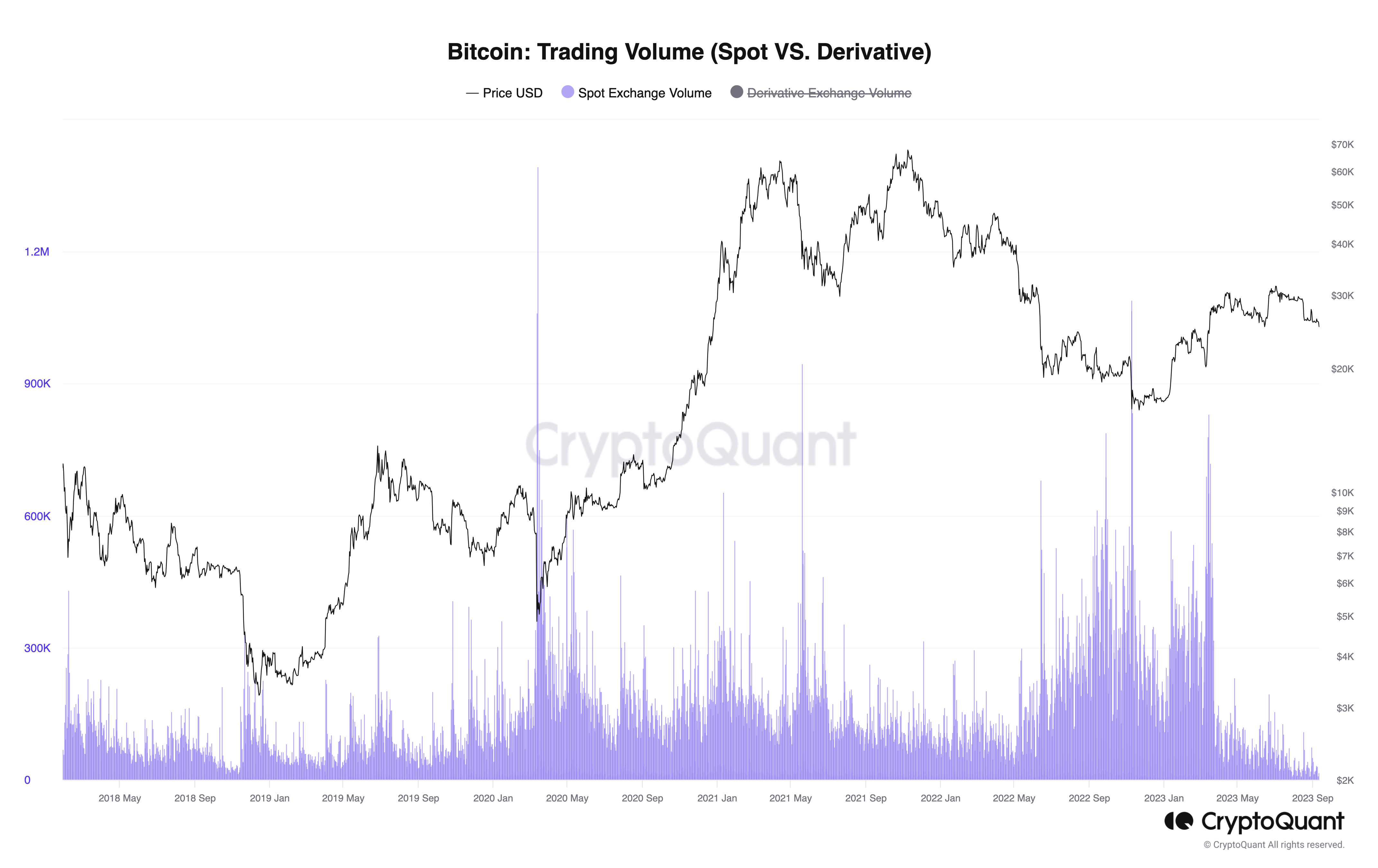

Recent research findings from CryptoQuant, an insightful on-chain analytics platform, have shed light on a rather unusual scenario: daily BTC volumes are presently hovering at levels seldom witnessed since the year 2018.

The Federal Reserve's actions make Bitcoin investors cautious about a potential economic downturn

Investors in Bitcoin are approaching the market with a measure of caution, largely due to the Federal Reserve's actions, which have triggered concerns regarding a looming recession. The price of Bitcoin has maintained a relatively stable stance for several months, and as time progresses, the enthusiasm for engaging in transactions seems to be waning.

Drawing upon CryptoQuant's comprehensive data, which meticulously tracks activities across both spot and derivatives exchanges, one can clearly observe a substantial reduction in trading volumes since the BTC/USD pair entered its existing range back in the month of March.

In the past week, the daily count of spot exchange transactions ranged from a modest 8,000 to 15,000—a mere fraction of the typical daily tally observed in the month of March, which consistently surpassed a staggering 600,000 transactions.

Caue Oliveira, a valuable contributing analyst, identified a significant factor driving this trend—the prevalent macroeconomic climate. He aptly stated, "One of the primary reasons cited is the mounting apprehension surrounding the macroeconomic landscape." Oliveira further shed light on the economic policy in the United States, where the Federal Reserve has been navigating between interest rate hikes and pauses throughout the year 2023, maintaining an overall stringent monetary environment.

Continuing in this line of thought, Oliveira noted that Bitcoin hodlers are consciously choosing to retain their BTC capital in response to these conditions. Instead of pursuing swift profits through short-term trading, an increasing number of individuals are viewing Bitcoin and other cryptocurrencies through the lens of a long-term investment strategy. They prioritize holding onto their coins, fueled by a belief in their prospective future value, rather than succumbing to the urge to sell at the first sign of profitability.

Bitcoin: Trading Volume (Spot vs. Derivative) chart. Source: CryptoQuant

Bitcoin: Trading Volume (Spot vs. Derivative) chart. Source: CryptoQuant

Not much encouragement for BTC price optimists

This current scenario presents little encouragement for BTC price bulls. Short-term holders—entities who hold BTC for a maximum of 155 days—are finding themselves with funds at an unrealized loss, as their cost basis exceeds the prevailing spot price.

In additional research conducted just this week, Yonsei_dent, yet another insightful contributor from CryptoQuant, issued a cautionary note regarding the cost basis of recent Bitcoin adopters, indicating that it could potentially pose a formidable resistance. He elaborated, "Excluding investors with a long-term holding perspective (1.5 years - 12 months) + HODLers, those who have recently entered the market are believed to have a stronger inclination towards short-term buying and selling activities."

This insightful analysis was complemented by a visually informative chart illustrating unspent transaction output (UTXO) numbers categorized by age band, effectively forming resistance and support levels.

Bitcoin UTXO age bands annotated chart (screenshot). Source: CryptoQuant

Bitcoin UTXO age bands annotated chart (screenshot). Source: CryptoQuant

Meanwhile, the external interest in BTC exposure continues to remain conspicuously subdued. Data from Google Trends reveals the lowest levels of interest in the search term "Bitcoin" since the bygone days of October 2020.

Read more: Bitcoin Legitimacy: A Shanghai Perspective

Trending

Press Releases

Deep Dives