Bitcoin: Shifting Tides and Hesitant Holders

Bitcoin's ticker, BTC, has taken a nosedive to $26,508, causing a state of panic among speculators. Recent research reveals that an overwhelming 97.5% of short-term Bitcoin holders are currently facing unrealized losses.

In the most recent issue of their weekly newsletter, "The Week On-Chain," analytics company Glassnode highlighted the struggles of Bitcoin's short-term holders (STHs).

Research highlights a significant decline in Bitcoin sentiment that shouldn't be underestimated

These are individuals or entities holding onto their coins for 155 days or less. Their combined cost basis has faltered due to a lack of market support.

As of September 17th, Glassnode notes that the cost basis for those who haven't spent their BTC is now at $28,000, which is approximately 5% higher than the current spot price.

Glassnode's research further discerned a relationship between sudden shifts in implied profitability (unrealized) and the change in spending behavior by STHs (realized profitability), resulting in what they term a "significant alteration in sentiment."

This suggests a degree of panic and negative sentiment has taken hold in the near term.

Bitcoin STH holder and spender data annotated chart (screenshot). Source: Glassnode

Bitcoin STH holder and spender data annotated chart (screenshot). Source: Glassnode

"A sense of anxiety and concern"

The findings align with the pervasive sense of caution prevailing among Bitcoin traders and analysts, many of whom anticipate a further dip in prices. However, there's no unanimous agreement on this outlook, as optimists are hopeful for a positive turn in BTC's performance starting in Q4.

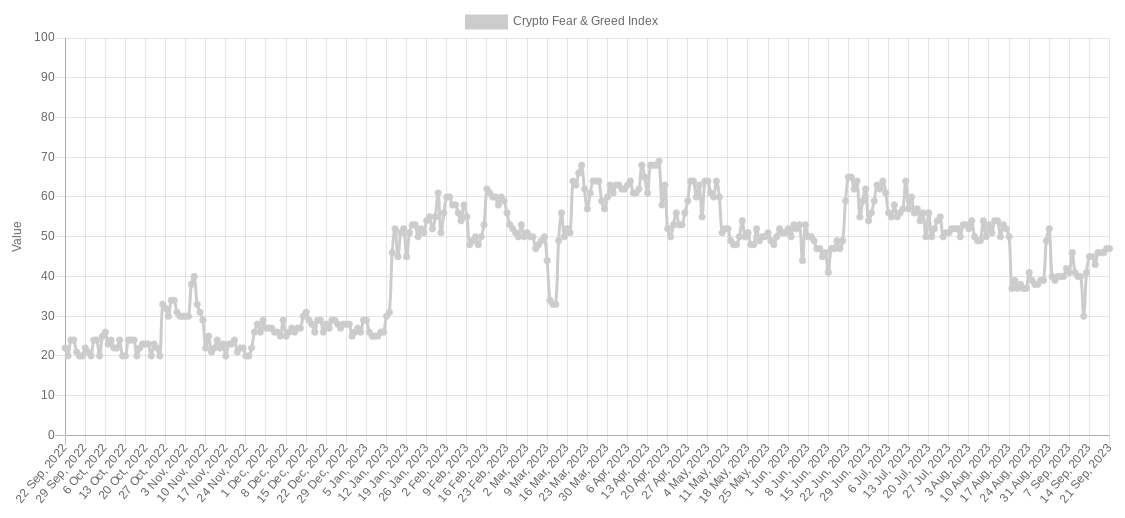

Meanwhile, the Crypto Fear & Greed Index, a classic sentiment gauge, remains only mildly bearish at the present price levels.

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

Nonetheless, for short-term holders, the looming threat of permanent loss is all too palpable. Glassnode analysts introduced a trend confidence metric that calculates the shift in sentiment by subtracting spender cost basis from holder cost basis and then dividing by the BTC price. This analysis concludes that the Bitcoin market is indeed undergoing a significant change in sentiment, with almost all short-term holders now finding themselves at a loss with their holdings.

Bitcoin new investor confidence annotated chart (screenshot). Source: Glassnode

Bitcoin new investor confidence annotated chart (screenshot). Source: Glassnode

Read more: eToro Expands Crypto Services Across Europe

Trending

Press Releases

Deep Dives