Bitcoin Insights: Market Dynamics and Price Outlook

Bitcoin (BTC), often symbolized by the ticker BTC, witnessed a slight downturn, touching $27,888. This subtle dip added to the already existing pressure to surpass the symbolic $28,000 threshold. Traders were especially vigilant due to the prevailing geopolitical uncertainties, which injected an element of unpredictability into the market.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Trader expresses dissatisfaction with Bitcoin's response to resistance

A discerning trader pointed out some apprehensions about Bitcoin's struggle against resistance. Analyzing the data on TradingView, it was apparent that Bitcoin managed to maintain stability, avoiding any major downward spirals over the weekend.

After a sudden retest of $27,000 on October 6, Bitcoin experienced a swift rebound, largely attributed to surprising employment data coming out of the United States. This data differed from the policy adjustments made by the Federal Reserve.

Looking ahead to the new week, market participants were keeping a keen eye on breaching the crucial $28,000 resistance level.

In a meticulous analysis of exchange order books on a lower timeframe (LTF), a prominent trader known as Skew emphasized the necessity for a significant influx of buying power to transform $28,000 into a sturdy support level.

"While delving into the LTF, it's evident that the market is still treating $28K as a resistant point. A substantial spot buyer is indeed needed to make a breakthrough in this area, in my opinion," this trader conveyed to X (formerly known as Twitter) subscribers.

Bitcoin order book data. Source: Skew/X

Bitcoin order book data. Source: Skew/X

Skew further scrutinized Bitcoin's reaction to both this level and the 200-day moving average (MA), which was presently situated at $28,040, describing it as suboptimal.

Another trader, Daan Crypto Trades, issued a caution against hastily shorting BTC if a sudden breakout were to occur. This, according to the trader, might potentially mark the inception of an upward trend.

"I'd like to emphasize that with BTC hovering around the pivotal $28K level, where the Daily/Weekly 200MA is currently situated, I'm not inclined to short any deviations above it," a portion of an X post outlined.

"Traditionally, we've observed weekend breakouts at such pivotal points, and they tend not to retrace as easily as they normally would."

Accompanying this analysis was a detailed chart illustrating the closing price of CME Bitcoin futures markets from the previous week. This closing price was anticipated to significantly influence prices in the upcoming week.

"Engaging in trading around the CME price is most effective during a period characterized by ranging and choppiness," he added.

"We are indeed currently within such a period, but that might potentially change with a strong breakthrough in this region. Hence, I'm exercising caution and not rushing into short positions, foreseeing a potential surge during the weekend."

BTC/USD annotated chart with CME Bitcoin futures data. Source: Daan Crypto Trades/X

BTC/USD annotated chart with CME Bitcoin futures data. Source: Daan Crypto Trades/X

Analyst reaffirms the prediction of Bitcoin reaching a $30,000 price

Shifting focus to market analysis, an analyst reiterated a forecast of Bitcoin's price reaching $30,000 in light of recent events in Israel. Others within the market also identified geopolitical instability as a potential catalyst for Bitcoin's price in the near future.

One of them, Michaël van de Poppe, the founder and CEO of trading firm MN Trading, anticipated a volatile week ahead in the market. According to his analysis, Bitcoin is likely to continue its upward trajectory, potentially reaching the coveted $30K mark amid the growing global uncertainties.

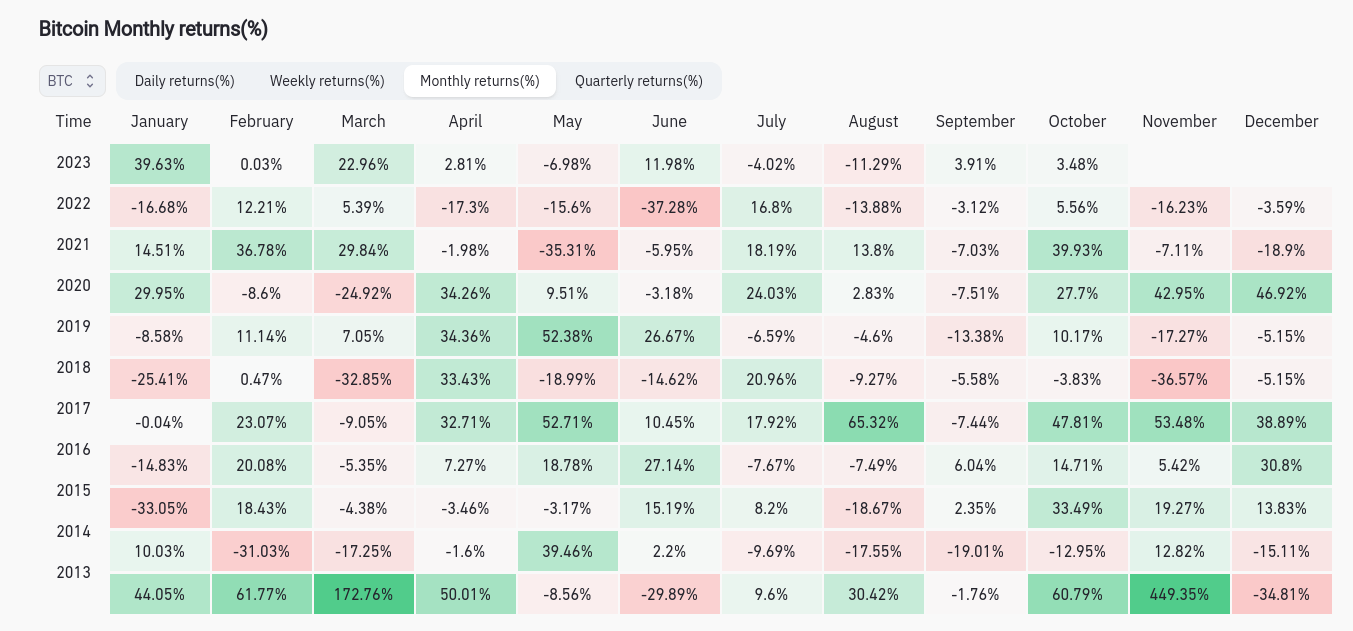

Van de Poppe had previously made an insightful prediction of a surge beyond the $30,000 mark in October, a month traditionally known for Bitcoin's robust performance.

At the time of writing, BTC/USD was hovering just below the significant $28,000 mark, reflecting a 3.5% increase in value month-to-date, based on data from the monitoring resource CoinGlass.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

You might also like: Charting a Course: Semiconductor Export Controls

Trending

Press Releases

Deep Dives