Bitcoin Insights: Market Analysis and Prospects

Bitcoin, often abbreviated as BTC, experienced a downward trajectory, briefly touching the figure of $27,019. This decline materialized as the bullish sentiments gradually lost their sway in the approach to September 30, a date of notable significance due to the impending monthly and quarterly closure.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin prepares for the closure of three significant candle periods

In anticipation of three pivotal candle closures, data from TradingView revealed a subtle cooling off in BTC's price action as it approached the highly anticipated September candle print.

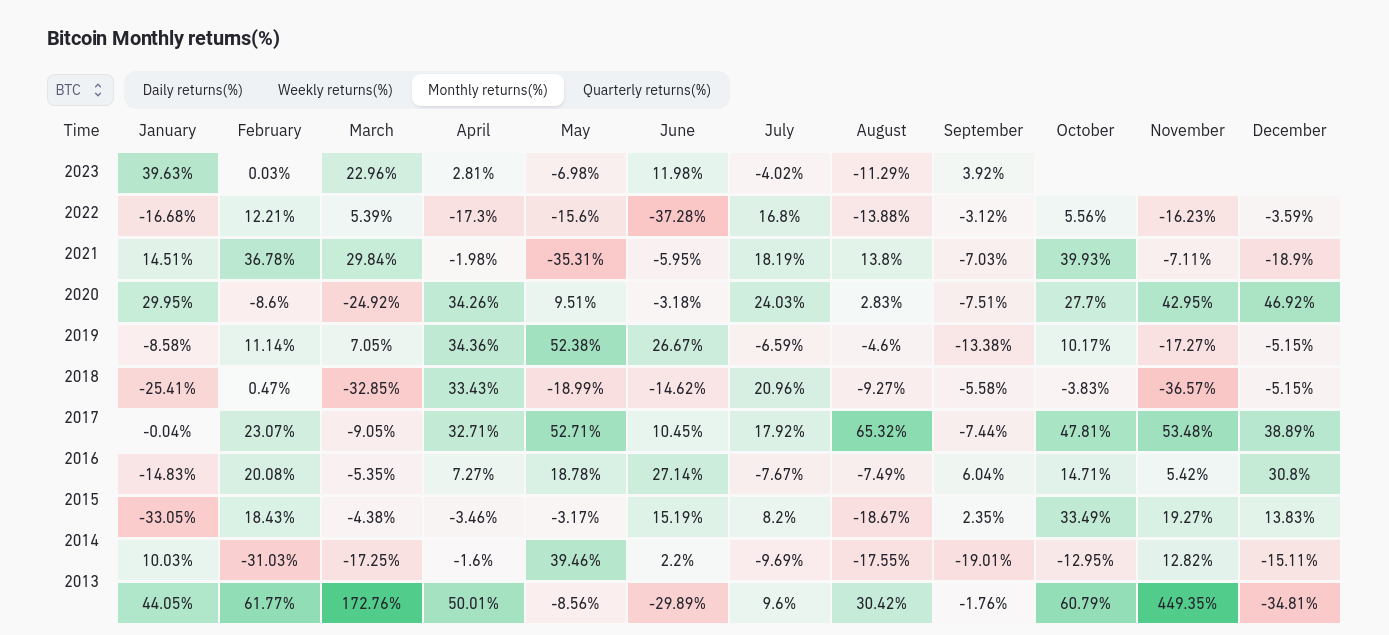

Despite this brief descent, the flagship cryptocurrency managed to hold onto a nearly 4% increase for the month, showcasing one of its most triumphant Septembers since the year 2016, according to data sourced from CoinGlass.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

On the flip side of this scenario, the quarterly performance for the third quarter displayed a decline of approximately 11.5% in the BTC/USD pair at the time of this report.

BTC/USD quarterly returns (screenshot). Source: CoinGlass

BTC/USD quarterly returns (screenshot). Source: CoinGlass

For traders and analysts closely watching the market, the final hours leading up to the monthly candle's conclusion carry an air of transformative potential.

"In the annals of history, a positive September has often paved the way for favorable outcomes in subsequent months like October, November, and December," highlighted Jelle, a trader with a notable following, in the day's comprehensive analysis.

Could we witness a replication of historical trends?

A mere day prior to this analysis, Jelle predicted a positive shift in conditions for the fourth quarter, envisioning a breakthrough beyond the psychological barrier of $30,000, a feat not achieved since the early days of August.

After months of accumulating coins, and slowly preparing us for the bull market, I think its time.

— Jelle (@CryptoJelleNL) September 29, 2023

Expecting Q4 to bring new strength -- and a break of $30k.

Send it.#Bitcoin pic.twitter.com/vkl0aq5hRS

"Typical indicators signaling a market downturn"

"Applying a lens of classic bearish technicals to the current market scenario, we observe..."

Meanwhile, Monitlonger's analysis delved into the fluctuations seen across both longer and shorter timeframes.

We are heading into the last #trading day of the month with textbook bearish Technicals from the Key Moving Averages on Daily, Weekly and Monthly TFs and #TrendPrecognition is flashing a new #TradingSignals on the #BTC Daily chart as if it knows we have a looming U.S.… pic.twitter.com/l9Mm2SHyFu

— Material Indicators (@MI_Algos) September 30, 2023

Looking forward beyond the imminent monthly and weekly closures, the specter of an impending United States government shutdown looms, potentially exerting further downward pressure on BTC's price action, unless a timely resolution is reached, the analysis elaborated.

"Considering the intricacies of market dynamics, there exists a significant probability that major market players might escalate their strategic moves over the weekend coinciding with the daily, weekly, and monthly candle closures. It is of utmost importance for market participants to exercise caution and not fall prey to potential market traps," emphasized Keith Alan, a co-founder of Material Indicators, in additional commentary.

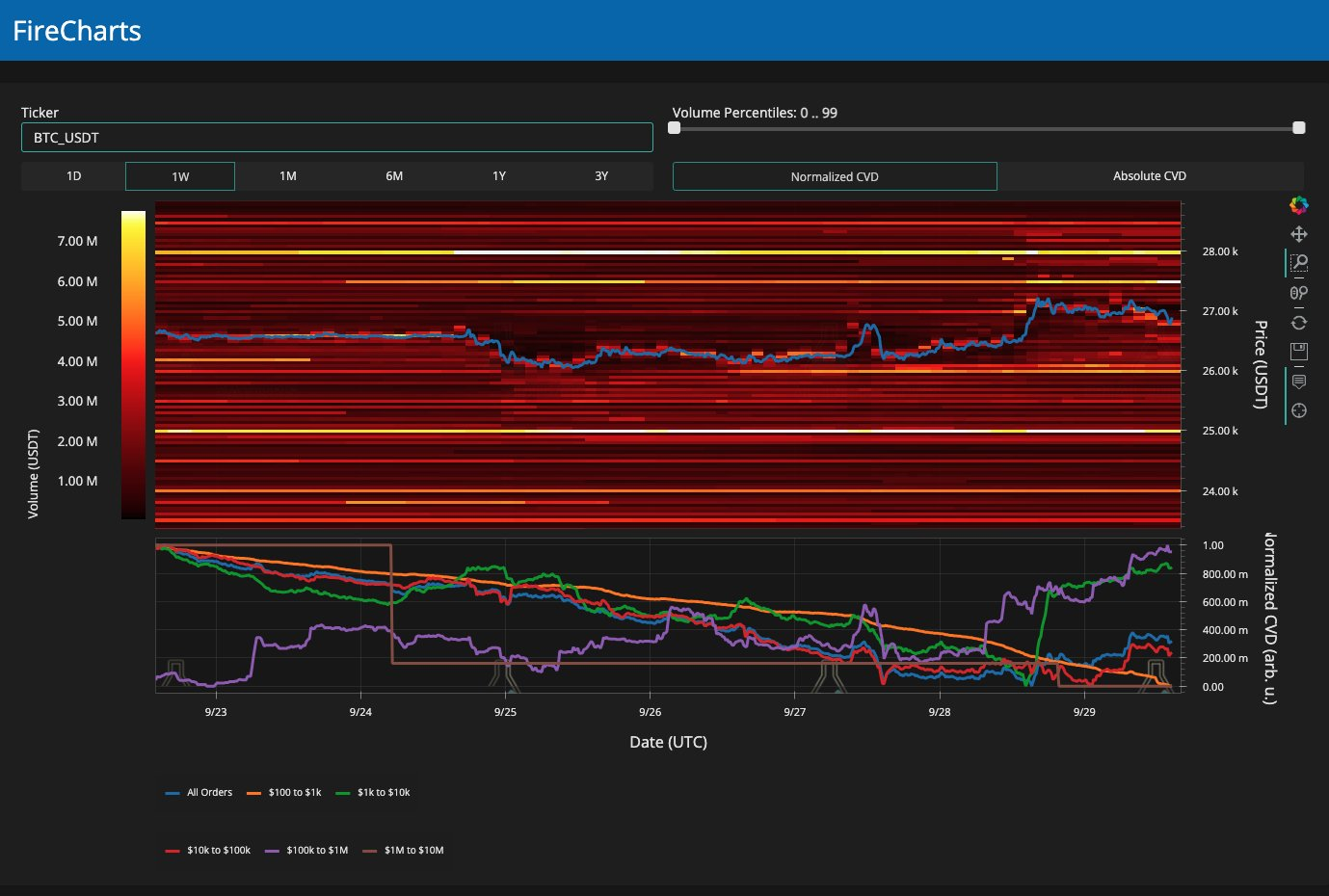

A careful examination of the BTC/USD order book on Binance, a prominent global cryptocurrency exchange, revealed a congregation of bid liquidity around the price level of $26,800, indicating potential market interest at that level. Conversely, sellers appeared poised and ready at the $27,500 price mark.

BTC/USD order book data for Binance. Source: Material Indicators/XContrarily, popular trader Daan Crypto Trades foresaw a period of relatively stable market conditions, at least until the cusp of the new week.

BTC/USD order book data for Binance. Source: Material Indicators/XContrarily, popular trader Daan Crypto Trades foresaw a period of relatively stable market conditions, at least until the cusp of the new week.

"While volatility made its presence felt last week, the decline in open interest suggests that the likelihood of witnessing anomalous price movements is minimal, at least until possibly later into Sunday," shared Daan Crypto Trades with X subscribers on that particular day.

In an accompanying visual representation through a chart, the CME Group Bitcoin futures' opening and closing prices were observed to potentially act as a magnetic force influencing BTC's spot price—a phenomenon commonly witnessed in the cryptocurrency market.

BTC/USD annotated chart. Source: Daan Crypto Trades/X

BTC/USD annotated chart. Source: Daan Crypto Trades/X

Read more: Ethereum's Compliance Landscape: A Transformational Shift

Trending

Press Releases

Deep Dives