Bitcoin Cash Surges in Liquidity During Q3, Outpacing Bitcoin and Ether: Kaiko Report

Market liquidity refers to the capacity of a market to handle significant trades without causing drastic price fluctuations.

For crypto traders seeking viable alternatives in anticipation of market turbulence, bitcoin cash (BCH), a derivative of bitcoin (BTC), might be a noteworthy option. According to Kaiko, a crypto data provider based in Paris, bitcoin cash demonstrated the most substantial enhancement in market liquidity during the third quarter.

Market liquidity, in this context, pertains to the market's ability to accommodate substantial buy and sell orders at consistent prices. The higher the liquidity or market depth, the narrower the slippage—i.e., the variance between the anticipated and actual transaction prices. This condition facilitates significant traders in executing sizable orders with greater ease.

Kaiko's assessment of liquidity rankings relies on metrics such as market depth, bid-ask spreads, and volumes from exchanges deemed "tradable." In general, there has been a pervasive decrease in market liquidity since the collapse of Alameda Research in November of the preceding year.

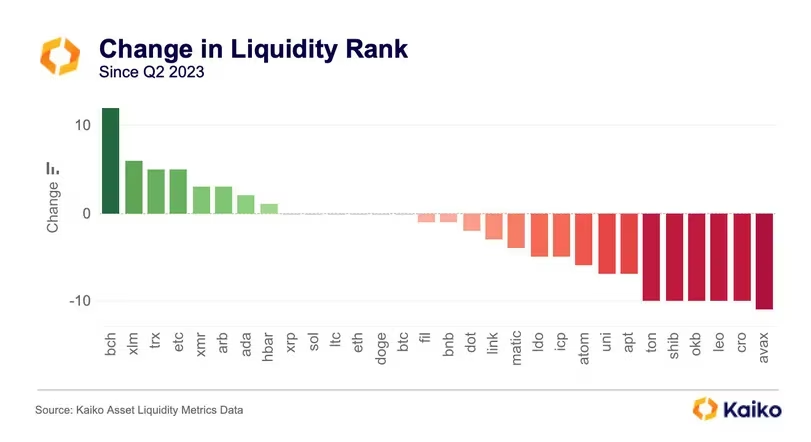

Bitcoin Cash (BCH) takes the lead in liquidity, while Avalanche (AVAX) experiences the most significant reduction in liquidity, according to data from Kaiko.

Bitcoin Cash (BCH) takes the lead in liquidity, while Avalanche (AVAX) experiences the most significant reduction in liquidity, according to data from Kaiko.

The data reveals that bitcoin cash exhibited a 10% plus upswing in market liquidity since the second quarter, surpassing other prominent alternative cryptocurrencies, as well as the leading cryptocurrency, bitcoin.

During the third quarter, bitcoin cash experienced a 23% decline in value, settling at $234—a retracement from the notable 145% surge it achieved in the second quarter. This cryptocurrency, ranked seventeenth by market capitalization, is available for trading on major centralized exchanges including Binance, Coinbase, Bitstamp, and the institutionally-backed EDX Markets.

Stellar's XLM, TRON's TRX, and Ethereum Classic (ETC) also demonstrated improved liquidity conditions. On the other hand, bitcoin, Ether (ETH), XRP, and Dogecoin (DOGE) showed no significant changes. BNB Chain's BNB, OKX exchange's OKB, and Toncoin (TON), however, experienced a decline in liquidity.

Kaiko noted in its quarterly report:

"TON had the worst underperformance relative to its market cap, as most of its volume is on HTX, which was removed for suspected artificial volumes; the token was not considered liquid on any exchange."

Overall, bitcoin retained its position as the most liquid cryptocurrency, reinforcing its status as a safe haven in the crypto market.

Read more: Slashing Saga: Lido's ETH Staking Woes

Trending

Press Releases

Deep Dives