Bitcoin Ballet: Halving Chronicles

Bitcoin has taken a bit of a tumble, witnessing a downtrend in tickers to a meager $38,194. This descent in BTC values coincides with the commemoration of the inaugural halving that unfolded precisely 11 years ago. As the crypto community raises its metaphorical glass to toast this historic occasion, let's take a leisurely stroll down Bitcoin's memory lane, exploring its noteworthy milestones that pave the way for the eagerly anticipated halving slated for April 2024.

Rewind to a distant past, almost 15 years ago, precisely on January 3, 2009, when the first-ever Bitcoin transaction unfolded. This happened just a few months after the mysterious creator, Satoshi Nakamoto, unveiled the intricate Bitcoin white paper in October 2008. Now, fast forward to November 28, 2012, marking the three-year and ten-month mark post the mining of Bitcoin's genesis block. It was during this time that the cryptocurrency, valued at a humble $12, found itself standing a whopping 308,200% below its present-day valuation, according to CoinGecko.

While Nakamoto's white paper doesn't explicitly unravel the intricacies of Bitcoin's halving and the imposing 21 million supply cap, it drops subtle hints about mechanisms orchestrating the birth of new BTC. In the document's eloquent language:

"To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they're generated too fast, the difficulty increases."

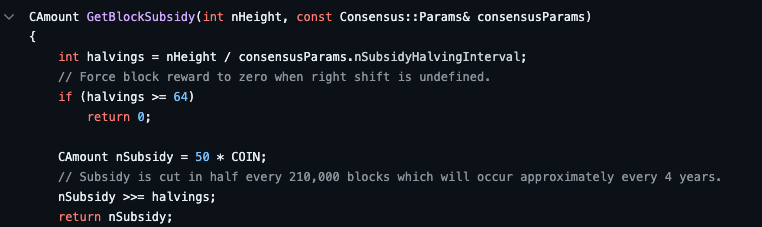

Now, let's dive a bit deeper. While some fundamental details about Bitcoin are curiously absent from Nakamoto's white paper, the elusive halving aspect is snugly tucked away in the Bitcoin source code. Found in the validation.cpp file within the Bitcoin Core GitHub repository, the code nonchalantly mentions that the miner's block subsidy undergoes a "cut in half every 210,000 blocks, which will occur every four years."

A Bitcoin halving-related snippet from the Bitcoin Core repository. Source: GitHub

A Bitcoin halving-related snippet from the Bitcoin Core repository. Source: GitHub

Delving into the coding labyrinth, we uncover that the BTC mining algorithm itself harbors the halving mechanism, strategically designed to combat inflation by clutching tightly onto the reins of scarcity. Before the grand debut of the first halving, miners were reveling in a bountiful 50 BTC per block, a number that dwindled to 25 BTC post the 2012 event, and further descended to 12.5 BTC after the 2016 halving. The most recent halving in 2020 witnessed the block subsidy gracefully bowing out from 12.5 BTC to 6.25 BTC.

Now, let's splash a bit of context on the canvas. The scarcity induced by Bitcoin halvings has waltzed hand in hand with the cryptocurrency's price cycle. Within a year of its first halving, Bitcoin leaped to nearly $1,000. The second halving, akin to a magician's wand, conjured a spectacular 350% surge, propelling BTC to its then-all-time high of nearly $20,000 in December 2017. Post the third halving, Bitcoin ascended to its zenith, reaching almost $69,000 in November 2021.

Now, as the crypto community eagerly awaits the grandeur of the fourth Bitcoin halving scheduled for April 17, 2024, the air is thick with anticipation and optimism. Enthusiasts hold their breath, contemplating the possibility of U.S. securities regulators nodding approvingly at a spot Bitcoin exchange-traded fund.

But wait, the drama doesn't end here. The 2024 halving is not the final act; there are 34 more halvings choreographed in Bitcoin's grand ballet. The miner reward, akin to a ticking clock, is poised to be halved until it eventually dwindles to 0 BTC, an event that will unfold after all 21 million Bitcoin are unearthed. If we consult the cosmic calendar, the grand finale, marked by the maximum supply of 21 million Bitcoin, is scheduled for an entrancing performance around the year 2140.

Read more: The Potential of a Digital Euro: A Solution Beyond Traditional Deposits

Trending

Press Releases

Deep Dives