ARK's Ethereum ETF Saga: Navigating Financial Frontiers

In a monumental collaboration that seems to mirror the alignment of constellations, ARK Invest and 21Shares have embarked on a transformative journey into the uncharted waters of Ethereum futures exchange-traded funds (ETFs). This strategic maneuver unfolds against a backdrop of whispers within financial corridors, hinting at the imminent nod from the enigmatic U.S. securities regulator, whose blessing could redefine the investment landscape.

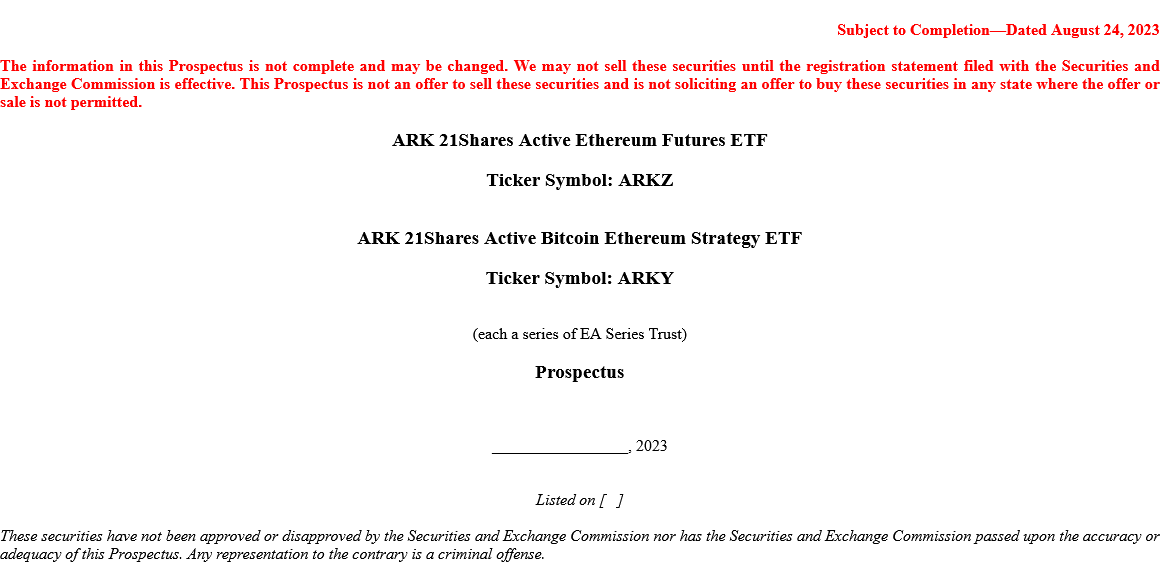

As the spotlight intensifies, directing its luminous beam onto the center stage, emerge two visionary ETFs that seem to transcend the mundane – introducing the "ARK 21Shares Progressive Ethereum Futures ETF" (ARKP) and the "ARK 21Shares Ethereum-Bitcoin Fusion ETF" (ARKEB). The filing, a meticulously crafted manuscript submitted to the revered Securities and Exchange Commission on that pivotal August 24, appears poised to script a new chapter in the annals of financial innovation.

Delving deeper into this financial odyssey, ARKP boasts a strategic allocation strategy that reserves no less than a quarter of its comprehensive portfolio to be entrusted to Ethereum futures contracts. These ethereal contracts, elegantly settled within the ethereal realm of cash, echo the very essence of contracts unfurled by the illustrious Chicago Mercantile Exchange (CME). In stark contrast, ARKEB orchestrates a harmonious convergence of futures agreements from both the Bitcoin and Ethereum universes, seamlessly weaving a symphony of possibilities that resonates with the pulse of innovation.

Submitting a fresh pair of applications to the SEC, ARK 21Shares has ventured into the realm of Bitcoin and Ethereum ETFs once again, as confirmed by sources within the Securities and Exchange Commission.

Submitting a fresh pair of applications to the SEC, ARK 21Shares has ventured into the realm of Bitcoin and Ethereum ETFs once again, as confirmed by sources within the Securities and Exchange Commission.

Steering this ship of financial exploration as the appointed investment advisor is Empowerment Funds – a guardian of financial sagacity chosen with the precision of a master artisan. A page borrowed from history reminds us of the duo's initial foray onto the global stage, capturing attention with their avant-garde Bitcoin ETF initiative back in the annals of 2021.

Yet, as with any saga of trailblazing endeavors, this narrative has been punctuated with regulatory plot twists. The vigilant gatekeepers of the financial realm, the SEC, thwarted the initial overtures in March 2022 and again in the chill of January. A recent overture for a Bitcoin ETF graced the scene in April – a mere couple of months prior to the entry of the financial behemoth BlackRock, a titan managing an astronomical $10 trillion, into the ETF arena.

A strategic twist, like an unexpected gust of wind shaping the course of sails, emanates from the SEC. Murmurs reveal a palpable discontent with the tapestry of existing Bitcoin ETF petitions. This realization has prompted entities like ARK 21Shares and their visionary counterparts to embroider their applications with surveillance sharing agreements – an eloquent gesture underscoring their commitment to transparency and harmonious compliance with the regulatory symphony.

As the grand theater of financial anticipation raises its curtains, all eyes turn not only toward the fate of the "ARK 21Shares Vibrant Bitcoin Futures ETF" (ARKE) and the "ARK 21Shares Bitcoin Strategy ETF" (ARKF), but also toward the broader tapestry of ETF diversification and the unfolding chronicles of investment innovation. The stage is set, the narrative poised for its next exhilarating chapter, as these financial pioneers navigate uncharted waters in pursuit of a new investment frontier.

Trending

Press Releases

Deep Dives