Analyzing Bitcoin's Positive Trends: A Visual Exploration with 3 Compelling Charts

- Turning Tides: Assessing the Zenith of Last Year's Global Central Bank Tightening Impact on Financial Markets, Including Bitcoin

- Contrary Currents: Easing U.S. Financial Conditions Amidst the Federal Reserve's Higher-For-Longer Interest Rate Stand

- Anticipating Opportunities: The Continuing Descent of the U.S. 10-Year Treasury Note and Its Positive Implications for Risk Assets

Indicators related to global central banks, the financial conditions in the United States, and the 10-year U.S. Treasury yield collectively suggest a favorable trajectory for Bitcoin. The digital currency has demonstrated a significant surge of 120% throughout the current year, with analysts foreseeing additional gains in the short term. Key factors contributing to this optimistic outlook encompass the anticipation of the U.S. Securities and Exchange Commission (SEC) approving one or more spot exchange-traded crypto funds (ETFs) and the forthcoming halving of the Bitcoin blockchain's mining reward scheduled for April.

Global central bank policy cycle

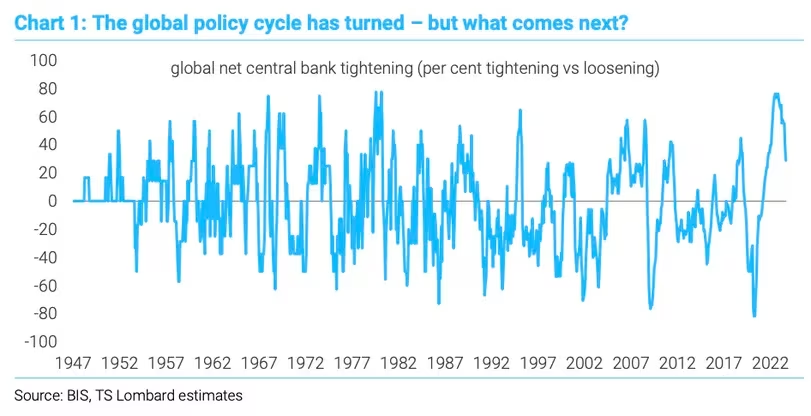

The Crest of the Global Tightening Wave: Insights from BIS and TS Lombard Estimates

The Crest of the Global Tightening Wave: Insights from BIS and TS Lombard Estimates

The support for this positive scenario extends to macroeconomic indicators, as reflected in charts depicting a positive reversal in the elements that played a role in the price crash of the previous year. An essential metric, indicating the balance between central banks tightening and loosening since 1947, signifies a shift toward easing liquidity. This implies that the global tightening cycle observed last year has reached its peak, potentially paving the way for increased liquidity and potential inflows into the cryptocurrency market.

With global inflation rates decelerating, central banks now have the flexibility to ease tightening measures. This historical development aligns with increased activity in the cryptocurrency market, as Bitcoin, renowned for its responsiveness to global liquidity conditions, tends to experience rallies during periods of abundant circulating capital.

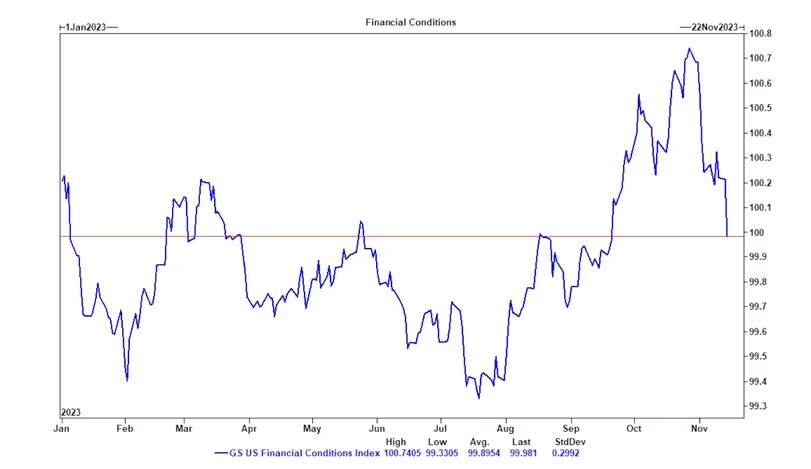

U.S. financial conditions ease

A comprehensive analysis of Goldman Sachs' U.S. Financial Conditions Index (FCI) since January reveals a notable decline from the year's peak, indicating a resilient U.S. economy. The FCI, influenced by short-term and long-term interest rates, the U.S. dollar exchange rate, credit spreads, and equity prices, offers insights into economic well-being. The recent decrease in the index corresponds with the Federal Reserve's commitment to maintaining higher interest rates for an extended duration, presenting a positive environment for risk assets, including cryptocurrencies.

As per analysts from the Federal Reserve, financial conditions constitute a "constellation of asset prices and interest rates." These conditions are dynamic, subject to shifts based on the overall economic well-being and monetary policy decisions. Importantly, these conditions have the potential not only to influence asset prices but also to exert an impact on the broader economy.

Reversal of Fortune: Goldman Sachs Reports FCI Decline, Undoing September and October Tightening

Reversal of Fortune: Goldman Sachs Reports FCI Decline, Undoing September and October Tightening

Breakdown in the 10-year Treasury yield

Moreover, the decrease in the yield on the U.S. 10-year Treasury note, attributed to a more gradual pace of bond purchases, is viewed favorably for Bitcoin. A bearish head-and-shoulders technical pattern observed in the 10-year yield chart indicates potential support levels, influencing investor behavior to seek higher returns through alternative assets such as cryptocurrencies.

Visualizing Trends: Analyzing the Daily Chart of the U.S. 10-Year Treasury Yield on TradingView

Visualizing Trends: Analyzing the Daily Chart of the U.S. 10-Year Treasury Yield on TradingView

Navigating Potential Pitfalls: Assessing Risks in the Horizon

Despite these encouraging indicators, caution is warranted. Potential sources of price volatility in risk assets, including Bitcoin, include Japan's transition away from ultra-easy monetary policies, geopolitical uncertainties, concerns related to U.S. commercial properties, and the potential resurgence of inflation. Additionally, a reversal in the currently relaxed financial conditions, as indicated by Goldman's FCI index, could introduce a more assertive tone in Federal Reserve comments, leading markets to reassess the likelihood of another interest rate hike in the upcoming months and potentially decelerating the momentum of Bitcoin's upward movement. Stakeholders are advised to exercise vigilance and closely monitor these factors to navigate potential shifts in the market.

Read More: December Lunar Leap: Dogecoin's Physical Voyage

Trending

Press Releases

Deep Dives