Altcoin Appeal: Bitcoin's Decline in Crypto Futures Trading Market Share Amidst Rising Profits in Alternative Cryptocurrencies

As 2023 approaches its conclusion, the once-dominant standing of Bitcoin in the cryptocurrency market is undergoing a significant transformation. Recent data highlights a considerable decrease in Bitcoin's dominance in terms of futures open interest, plummeting from nearly 50% to 38% in the last two months. This shift signifies a noteworthy change in the behavior of crypto traders, who are increasingly diverting their focus toward alternative cryptocurrencies.

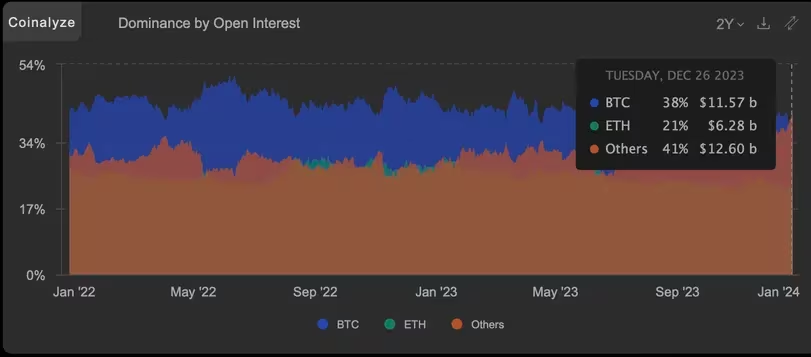

The monetary value locked in active futures contracts associated with Bitcoin now only constitutes 38% of the overall notional futures open interest across the market, totaling $30.45 billion. Coinalyze, a platform dedicated to tracking cryptocurrency data, reports that this figure represents the lowest point in at least two years.

In response to this situation, Coinalyze remarked,

"It appears that 'all' the funds are now flowing into alternative cryptocurrencies,"

linking the decline in Bitcoin's dominance in futures open interest to the escalating interest in alternative digital assets. This shift in investment patterns mirrors a renewed appetite for risk in the cryptocurrency market, a pattern commonly observed following a substantial upward trend in Bitcoin prices.

Bitcoin, the foremost cryptocurrency by market value, has undergone a significant surge of over 60%, reaching $43,100 since October 1. This surge is primarily attributed to diminishing Treasury yields and the anticipation of potential approval by the U.S. Securities and Exchange Commission for one or more spot Bitcoin exchange-traded funds (ETFs).

As of the most recent data available, Bitcoin has exhibited an impressive 161% increase on a year-to-date basis. Simultaneously, the second-largest cryptocurrency, Ethereum (ETH), has witnessed an 88% surge in its value over the same period.

Shifting Tides: BTC Open Interest Declines from 50% to 38% in Two Months, Coinalyze Reports

Shifting Tides: BTC Open Interest Declines from 50% to 38% in Two Months, Coinalyze Reports

The breakdown of dominance in terms of futures open interest further underscores the evolving dynamics within the cryptocurrency market. Bitcoin's dominance has dwindled from nearly 50% in late October to its present level of 38%, while ETH's dominance has remained relatively consistent at nearly 21%. Notably, the market share of alternative cryptocurrencies has experienced a substantial rise, climbing from 32% to 41%.

In summary, the data indicates a significant shift in investor preferences in the cryptocurrency realm, with a diminishing emphasis on Bitcoin and a burgeoning interest in alternative digital assets, commonly known as altcoins. This change in market dynamics highlights the ever-changing nature of the crypto landscape and the dynamic factors influencing investor sentiment and behavior.

Read More: Altcoin Ascendancy: Ether and Solana Surge to 19-Month Peaks Amid Bitcoin Rally Pause, Traders Cautious of 'Bull Trap

Trending

Press Releases

Deep Dives